This guest article is written by finance and investing expert Barbara Friedberg.

How to Get Started Investing With a Low Salary

Imagine this, you’ve got your first job, an apartment and you’re finally out on your own. Everything is great, almost. Your salary seems okay, until you tally up your expenses. That’s when reality sets in.

For most Americans, there’s more to buy than there is available income. For young adults, this is a reality more times than not. When Simone first started working in NYC, her $38,000 salary was squeezed to the bone. Amid the excitement of working in the most exciting city of the world was accompanying out-sized prices. For Simone and her friends, investing for the future was way down on the priority list. But, it shouldn’t be.

Why to Start Investing in Your 20’s

Here’s why you need to start investing now.

The average Social Security payment is $1,341 in 2016. An annual $16,092 retirement benefit doesn’t go very far. Even though retirement seems like a long way off, in order to have a comfortable future, you need to prepare early.

The earlier you start saving and investing, the less total dollars you’ll need to save. That wasn’t a typo. Due to the power of compound returns, start earlier and time will reward you with outsized returns upon retirement.

Consider the tale of Jack and Jill (excerpt from my, How to Get Rich Without Winning the Lottery)

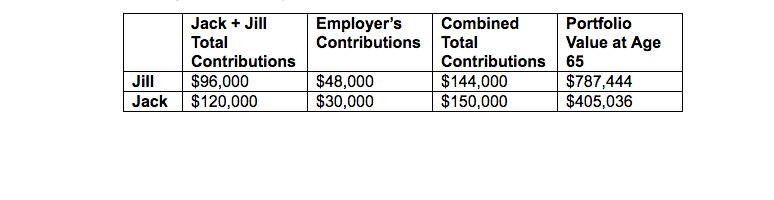

Jill began investing $200 per month into her workplace 401k retirement account at age 25. Her employer added another $100 per month into that same account, for a total of $300 per month. Jill never increased her contributions into her retirement account and continued investing until age 65. At that time her total retirement contributions grew to $787,444. (Assumes a 7% annual return.)

Jack wasn’t as planful as Jill and didn’t start saving and investing for retirement until age 40. Jack invested $400 per month, double the amount of Jill. His employer also added another $100 to Jack’s 401k retirement account for a total of $500 per month. When Jack reached age 65, after 25 years, his retirement account totaled $405,036.

So Jill contributed $96,000 into her retirement account between age 25 and age 65. Although when she first started, the $300 per month was quite a sacrifice, as her income grew, the $300 became a smaller and smaller percentage of her total salary. Because Jill started investing earlier than Jack, she was able to invest less, $96,000 total dollars invested in contrast with Jack’s $120,000 investment, and end up with almost twice as much in her retirement pot as Jack.

Would you start investing for retirement now if it meant that you could save less and yield more in retirement?

How to Begin Investing with a Low Salary

When I first started working, I earned $29,000 per year as a career counselor at San Diego State University. It was the most money I ever earned, but it didn’t go too far in sunny and expensive California. Not only that, but for the first few years, my husband was in school full time, which meant we had his tuition payments and no income initially.

When I attended the retirement investing seminar at work, and learned that my investments into my workplace 403b (similar to a 401k) would lower my taxable income as well as allow my money to grow tax free for decades, I couldn’t pass it up. I stashed as much as I possibly could into that account, and that meant we had to make big sacrifices in our lifestyle.

When you first start out, you have a decision to make. Do you want everything now if it will mean that you’ll struggle financially as you age, or would you prefer to sacrifice a bit now for a life of greater financial security? For us, the decision was clear. We knew we needed to live cheaply. We knew we would have to live really cheaply in order to be able to pay our bills and contribute to our retirement.

Ways to Boost Your Income and Live Cheap So You Can Fund Your Retirement Account

Not only did we live economically, but we also took on extra work. By our second year in San Diego, I began a small private career counseling practice. So, I earned some extra cash, on top of my job. During our second year, my husband started working part-time as well. Every bit of our extra money went to fund our retirement account. Actually, if you look at the retirement fund statements today, the account value increased over 500% in value in the subsequent years. (I never contributed to the account again, after I left that job.) If you’d like to find out the details of this particular investment situation, you can sign up for this wealth-building freebie.

So, there was a three-pronged approach to saving for retirement with a small salary. The first prong was to increase income. The second was to live cheaply. You would be shocked at how much money you can fritter away if you’re not careful. If you’re serious about creating a better financial life for yourself, then you need to take actions to lower your spending along with increasing your income. Finally, you need to contribute as much as you possibly can to your retirement account. And when you get a raise, you need to use part of that raise to increase your retirement plan contributions.

There are thousands of ways to cut back your spending, from bringing your lunch to work to designating ‘no shopping’ months, the list is endless. If you have the determination to free up money and start investing with a low salary, you can make it happen.

Now that you’re committed to earning more and spending less, you need to implement the final piece of the puzzle, how to start investing.

Where to Begin Investing Can Be Overwhelming

Beginning to invest can be overwhelming, but it doesn’t need to be. Experience and research has shown that a simple investing approach can yield excellent long term investment results. This final section lays out a simple investment strategy that will minimize your investment fees and investment management oversight.

1. Invest in your workplace retirement 401k or 403b, especially if you receive an employer match. Choose several broad index funds such as an S&P 500 index mutual fund or a target date fund. Raise the percent you invest in the account every time you receive a raise.

2. Open a Roth IRA if you can swing it. If you can’t afford to open the account today, consider funding one in the future, as your income rises. Again, fund the account with low fee index mutual funds. If you’re not too comfortable managing the money yourself, you may want to choose one of the ‘robo-advisor’ investment managers that do the investing for you for a low fee such as Wealthfront or Betterment.

Finally, the choice is yours. If you want a life with less money stress, then you can make it a priority to take on an additional roommate or skip that ‘bottle service’ at the club and fund your retirement account now.

Barbara Friedberg, MBA, MS is a former investment portfolio manager, author of Personal Finance; An Encyclopedia of Modern Money Management and How to Get Rich; Without Winning the Lottery. Friedberg is a former university Finance and Investments instructor, and publisher of Barbara Friedberg Personal Finance.com and Robo Advisor Pros. Her work has been featured in U.S. News & World Report, Yahoo! Finance, GoBankingRates, and many more publications. Follow her on Twitter, Google+ and Pinterest.

Save for the things that matter

Without giving up the things you love

Want your family’s financial future to feel safe and secure? Download my Easy Family Budget Worksheet and take control of your family’s finances in just 10 minutes!